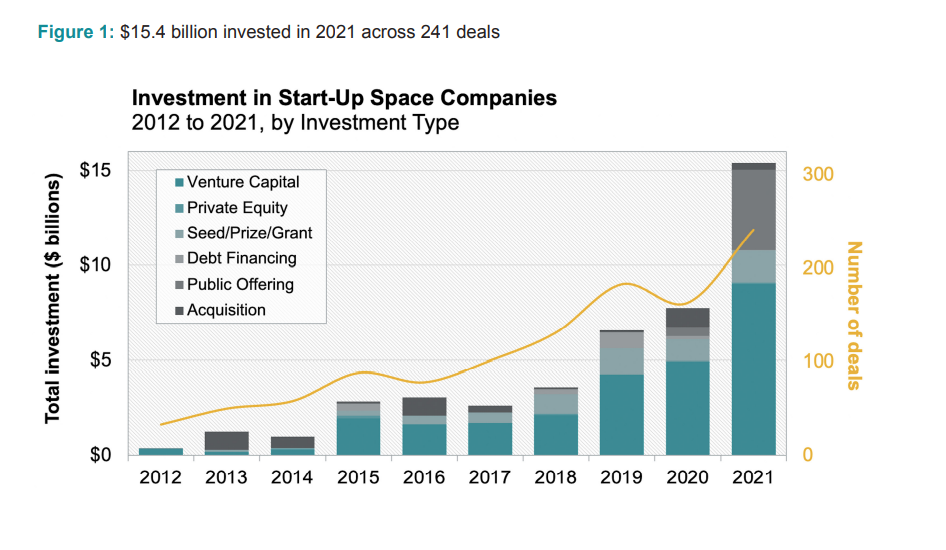

2021 was a record-setting year for start-up space funding. Private investors poured a historic magnitude of capital into start-up space companies, and public markets emerged as a significant source of funding for start-ups across all space categories. Start-up space companies attracted over $15 billion in total financing during 2021, breaking the $7.7 billion record set in 2020 (see Figure 1). In addition, 2021 was a record setting year for the number of start-up space deals (241, up 48% from 2020), recipients (212, up 46%), and average deal size ($64 million, up 35%).

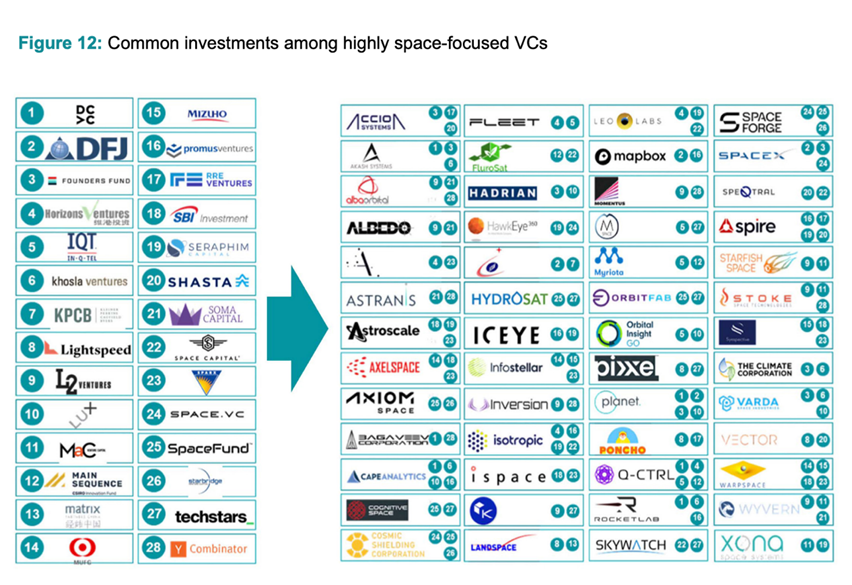

Twenty-eight venture capital firms invested in five or more start-up space companies in 2021. Seraphim invested in 16 companies making us the most prolific specialist Space-Tech Investor globally in 2021 (see Figure 12).

In addition to this data Seraphim's Space Camp Accelerator has stakes in 55 emerging space companies.

Since 2000, Sixty-three VCs have participated in at least five start-up space deals, multiple investment rounds or other specific transactions, which may include more than one investment in a single company. Seraphim lead this group, having participated in 26 start-up space deals since 2000.

We're delighted to be included in the Bryce annual review of global investment in the space tech start-up ecosystem, and can't wait to support more awesome Space-Tech companies in 2022 and beyond.

Read the full report here

Since 2000, Sixty-three VCs have participated in at least five start-up space deals, multiple investment rounds or other specific transactions, which may include more than one investment in a single company. Seraphim lead this group

unknownx500

unknownx500